Small Business Relief Grants - Round 2

The city is providing a limited number of relief grants to assist small businesses and non-profit organizations adversely impacted by COVID-19. (details)

Renton’s City Council has authorized $600,000 to support a Grant Program to provide relief to Renton businesses experiencing direct economic hardship due to COVID-19 using Federal American Rescue Plan funds. This program provides a limited number of $7,500 relief grants to small, Renton businesses that meet specific criteria. Applications close July 15, 2022 at 11:59 PM.

Questions regarding this grant program can be directed to City of Renton at [email protected] or calling (425) 430-7271. Please call if you need assistance completing the application or would like to request translation services.

Eligible Expenses

Grant funds can be used to support the cost of business interruption due to COVID-19 as a result of required closures, voluntary closures to promote physical distancing, or decreased customer demand, including:

· Payroll expenses

· Rent expense

· Utilities

· Machinery and equipment (Example: HVAC upgrade)

· Equipment needed to advance technology used in response to COVID-19

· Personal Protective Equipment (PPE) and/or sanitation supplies, equipment, and services

· Modifications and changes temporarily or permanent to business operations

Eligible expenses are those incurred by the business between March 3, 2021 and December 31, 2021.

Eligibility & Contract Requirements

To be eligible, businesses:

· Must be licensed to do business in the State of Washington and in the City of Renton and in operation on or before March 2020.

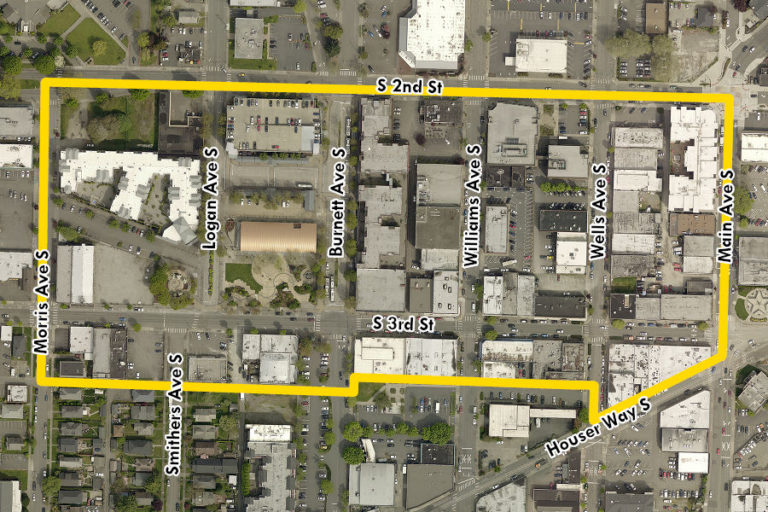

· Must have a physical office or storefront within the area identified in the map below.

· Must demonstrate negative economic impact due to COVID-19 by demonstrating loss of revenue.

· Only one application per business will be considered. Chains (national or local with 3 or more locations) will not be eligible for awards.

· Did not receive grant funding in the first round of the Program.

· To receive grant payment, the business owner is required to enter into a Grant agreement with the City; and

· Must comply with small business requirements of the US Department of Treasury Final Rule guiding the Coronavirus State and Local Fiscal Recovery Funds.

*Businesses opened in 2019 or 2020 should contact (425) 430-7271 or email [email protected] for an alternate application process

Application Process:

· Applications must be submitted no later than July 15 at 11:59 PM.

· Priority will be given to businesses on a first-come, first-serve basis.

· Complete the online application at rentondowntown.com/small-business-grant/

· If you do not have the ability to fill out the application and submit online, please email [email protected] or call (425) 430-7271 to pick up or be mailed a hard copy application.

Grant Awardee Notification & Disbursement Process:

· Applicants will be notified of grant decisions via e-mail for all online applications and via letter for hard copy submittals by the end of July 2022.

· If awarded, grant recipients must submit a W-9.

· Funds are distributed only with supporting documentation (proof of payment (canceled checks, bank statements, credit card statements, etc) for eligible expenses.

· Grants will be distributed via check payment between August 1 and August 31, 2022.

· Grant funds may be taxable. Please consult your financial advisor/tax professional for guidance. A 1099 will be issued, as required by the IRS no later than January 2023.

In their application, businesses must:

· Demonstrate a decline of in-person* gross receipts due to the COVID-19 pandemic by completing the revenue loss calculator. Businesses must provide applicable Department of Revenue tax return(s) that document annual gross receipts along with documentation to substantiate deduction of online sales.

*in-person gross receipts represent sales made at brick & mortar location; businesses may deduct from total annual receipts any web-based sales.